I may have got the wrong end of the stick here but if you buy a MH from, say, Germany do you pay the vat there or in the UK when you import it - or both ??

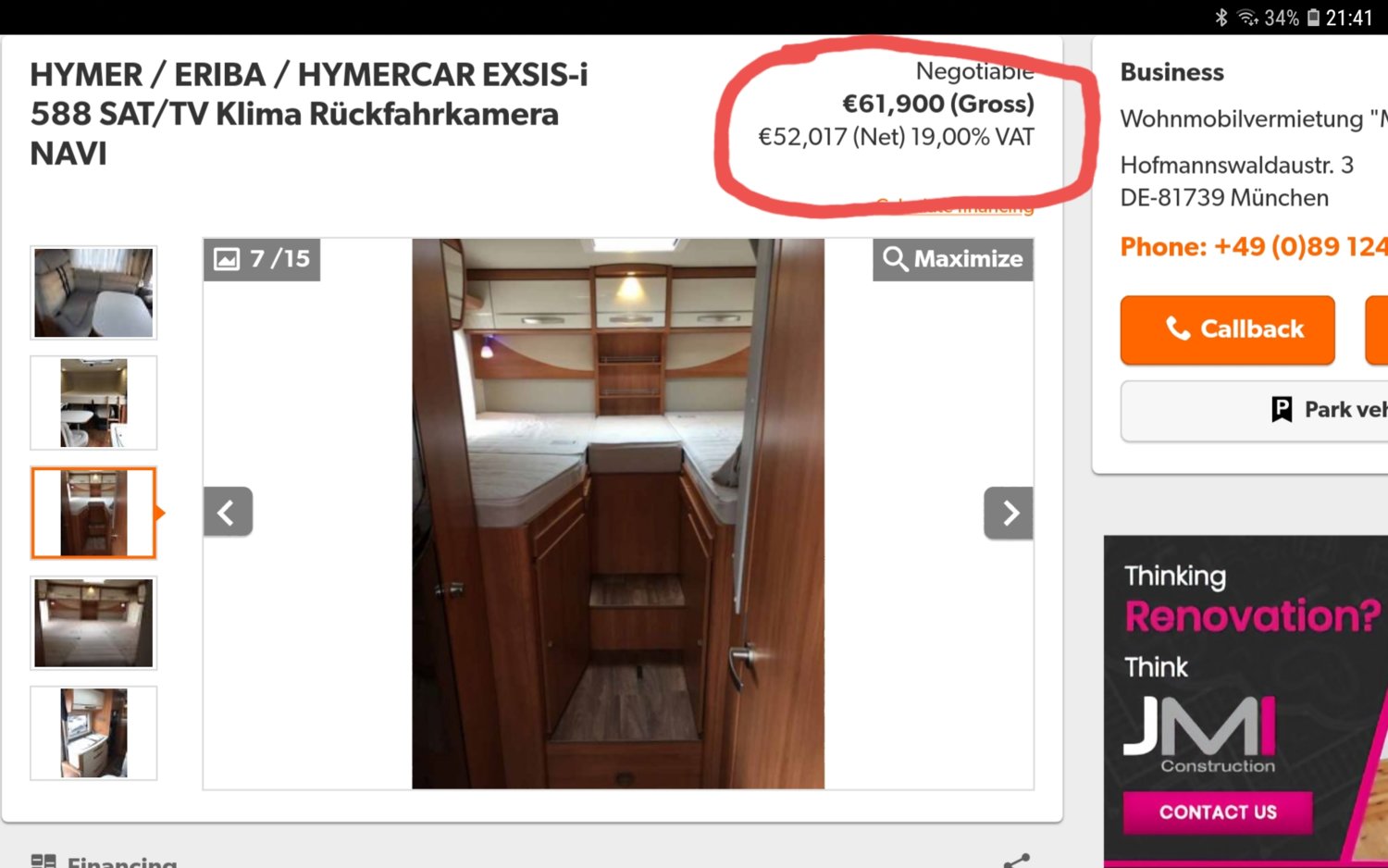

Can anyone tell me from the image below, in the ad from mobile.de, the bit that is circled red, how would that work?

Also, anyone ever tried to claim the Vat back if registered for Vat?

Barry

Can anyone tell me from the image below, in the ad from mobile.de, the bit that is circled red, how would that work?

Also, anyone ever tried to claim the Vat back if registered for Vat?

Barry